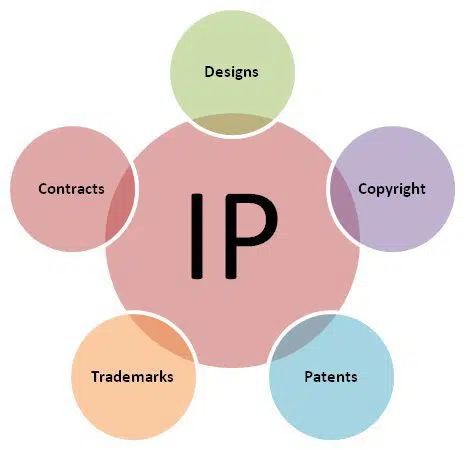

One of a company’s most valuable business assets is intellectual property (IP) rights. They are integral for protecting the company’s position in the market and can have immense value if they are properly obtained, managed, and enforced. Periodically, companies should conduct IP audits to understand what rights they have, the scope of protections that they offer, and thus what value the IP assets have for the company. Armed with a thorough understanding of the IP rights owned by the company, the company can make informed business decisions.

What is an IP Audit?

An IP audit is a process by which a company can develop a clear understanding of what intellectual property rights it owns, similar to taking an inventory of any asset the company owns. Additionally, an IP audit clearly assesses the scope and breadth of the rights that each piece of IP confers, and identifies what other protections are needed to secure value in the intellectual property owned by the company.

- Identifying all IP Assets. The first step to conducting an IP audit is to identify any and all intellectual property rights owned by the company. Any patent, registered trademark, or copyright registration should be considered as part of the audit. Pending patent applications, pending trademark applications, and trade secrets may also be considered. Licensed IP rights can also be included in an IP audit. Other less commonly encountered forms of IP that should be included in an IP audit include: trade dress, mask works (which is a special type of copyright), contracts/licensing agreements, domain names, and hyperlinks.

- Assessing the Rights Associated With Each Piece of IP. Once every piece of IP is identified, the next step is to determine what rights are associated with each piece of IP. By determining what rights the company has for each piece of IP, a value can be placed on the IP right. For instance, the company may own a patent for one of its products, but if the company has an exclusive licensing agreement in place that licenses the right to use the product to a third party, then the company does not have the right to use the patented invention, even though the company still owns the patent. The patent still has value for the company, but the right to use is tied up in a licensing agreement until the time when the licensing agreement terminates.

- Secure Rights for Gaps in IP Protection and Addressing Deficiencies. After assessing what IP the company has and what rights the company has in their IP, the company needs to evaluate if there are any gaps or holes in their IP protection and take steps to secure the appropriate forms of IP to fill those gaps. Additionally, if the following have not already been done then ownership should be established for each piece of IP, recordation of transfers should be verified, and security interests in the IP should be perfected.

When Should IP Audits Be Conducted?

There are many situation that arise in business where an IP audit is prudent. A few examples of when an IP audit should be conducted by a business include:

- As a general rule, IP audits should be conducted at least once a year at the same time each year during the normal course of business.

- IP audits are useful in any situation where due diligence is necessary or after a major business event. For instance, an IP audit is a good idea whenever there is a merger, acquisition, or significant purchase of stock,

- IP audits are important whenever there is a transfer of intellectual property by way of a transfer, assignment or sale.

- IP audits should also be conducted prior to entering into new or renewed licensing agreements.

- When there is a significant change in the law, it may be smart to conduct an IP audit to reevaluate the company’s IP assets in view of the changes in the law.

How to Determine Intellectual Property’s Value

The value of IP can be difficult to pin down if you do not have any experience with IP valuation. Companies should hire specialists to conduct IP value determinations. There are three main approaches to IP valuations, and which is most appropriate for your company’s situation depends on the IP you own, the purpose of the valuation, and the amount of available data about the IP assets that are being evaluated. The three approaches include:

- The Income Approach. The most common IP valuation approach is the income based approach, which looks at how much money the IP generates and can generate in the future for the company based on the remaining life of the IP. This valuation approach takes into consideration any income generated by the IP at present, and extrapolates into the future the possible income that can be generated from the IP.

- The Market Approach. When there are similar IP rights being bought and sold or licensed in the market, it is possible to conduct a valuation of your company’s IP rights based on comparable transactions for IP that are taking place in the marketplace.

- The Cost Approach. The cost approach assigns a value to the IP asset based on how much it would cost to reproduce or obtain the asset. This approach looks at all the costs that go into securing the IP and assigns this amount as the value of the IP asset.

What are Common Pitfalls in an IP Audit?

Many common mistakes that companies make when it comes to IP audits can be incredibly costly in the long run. That is why it is best to avoid potential pitfalls in your company’s IP audit. Some examples include:

- Not Getting an IP Audit. One of the biggest mistakes that companies make concerning IP audits is not getting an audit in the first place. Without an IP audit, your company has no idea or record of all of the IP assets you have and has no way to value those assets. It is impossible to make an accurate valuation of the company without an inventory of the IP assets you have.

- Mistaken About What IP Assets are Owned. Businesses sometime think that they own IP rights that they actually do not own. An IP audit helps identify what assets the company owns, which assets it does not own, and provides solutions on how to rectify this situation.

- Making Assumptions About What IP Rights Entail. Businesses that have an incomplete understanding of what their IP rights entail might mistakenly assume that they have more rights than they truly do. For instance, registering a domain name is not the same as trademarking the word used in the domain name. Just because a company registers a domain name does not mean that the company has the right to use it, especially if someone else owns a trademark on the name used in the domain name.

Contact an Experienced IP Audit Lawyer

An experienced intellectual property lawyer who has a strong understanding of business is likely the most qualified individual to handle an IP audit for your company. The professionals at Revision Legal can help you conduct an IP audit for your company’s intellectual property assets. Contact us today using the form on this page or call us at 855-473-8474.

Image credit to Flickr user arinobe.