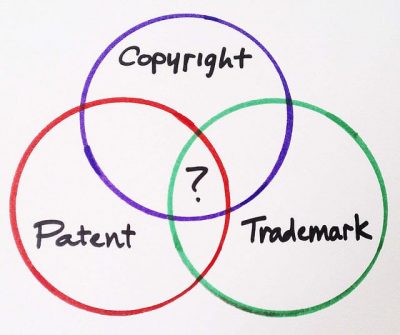

One of the most useful and valuable assets a company can possess are intellectual property (IP) rights. IP rights are intangible assets that can be leveraged just like physical assets because they have value. IP rights take many forms including patents, trademarks, copyrights and trade secrets, brand, goodwill, etc. When a company possesses a multiplicity of intellectual property rights, it is important to organize and manage those rights to maximize the value that can be derived from them for the company.

What is an Intellectual Property Portfolio?

When a company possesses a collection of intellectual property rights, it is referred to as an intellectual property portfolio. There is usually a commonality to the intellectual property rights that are in an IP portfolio. For instance, an IP portfolio might be developed for the entire company, which might include trademarks for the company’s name and logo, copyrights for the company’s marketing materials, and patent protection on a product owned by the company (particularly when the company is based on marketing a single main product).

Alternatively, companies sometimes develop IP portfolios around a single product. For instance, if a company develops a product that has a software component, the company might build an IP portfolio that is limited to the intellectual property rights related to that specific product. By way of example, the portfolio might contain patent rights related to the product and the software, copyrights related to the object code and script of the software, and trademark rights related to the product name and product logo.

A Well Managed IP Portfolio Can Be Valuable

Managing your company’s intellectual property portfolio is just as important as managing your business. Having comprehensive intellectual property protection on a product is desirable and can be highly valuable to a company. Carefully picking and choosing what IP rights are important, and how much scope they have can carve out a section of the market that is exclusively held by your company.

- Using an IP Portfolio as a Barrier to Entry. An IP portfolio can prevent competitors from entering your commercial space. For example, owning a patent portfolio around a novel technology that includes a patent or the main product, as well as additional patents covering a number of useful variations of the invention, prevents competitors from making, using, selling, or importing the invention/product or anything similar that falls within the patent protected space. In effect, a well-planned patent portfolio creates a space of protection in the relevant field that others are prohibited from entering.

- Using an IP Portfolio to Attract Investors. The barrier to entry created by an IP portfolio is attractive to investors because it shows that the company has an exclusive space in the market. Similarly, investors like to see that a business cares enough about their product or business to obtain intellectual property to protect it.

- Selling an IP Portfolio. When someone purchases the intellectual property rights associated with a product or company, the IP is more valuable if the IP portfolio is comprehensive.

Intellectual property rights are valuable business assets. The professionals at Revision Legal can help you secure, protect, enforce and manage your company’s intellectual property assets. Contact us today using the form on this page or call us at 855-473-8474.